Posted On: Wednesday - January 30th 2019 8:56AM MST

In Topics: Trump Economics Americans US Feral Government Taxes

This post is not about the political aspects of the > 100 y/o US Federal Income Tax, so much as just THE MONEY! Peak Stupidity has discussed the Trump-signed, slightly-favorable, tax change law over a year ago in Merry Christmas from

It's that time of year again, when

Purposefully (using the W-4 forms over the year) arranging to have a refund coming at tax time is not really wise. It's true that it's nice to have the US Gov't saving money for you, so you can't touch it in the meantime, but, well, that does put you back into the group of poor planners, or just those who are not disciplined enough to save. However, though, granted, for now one still can't get more than approximately JACK-SQUAT in interest on any savings that is not large and/or in something risky, why would you want the US Gov't to have use of your money, if you don't even have to? Secondly, the IRS ends up with leverage over you, if you are owed money, rather than if you owe them some. I've got a story on this for another time.

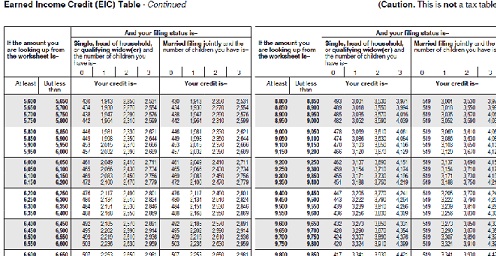

To the point of this post, finally, different income-level Americans have to have different strategies, and attitudes, regarding the IRS. Let's put us into 4 groups, starting with the low-income, and (usually) poor-planning folks who see this kind of form*:

** stolen from some other taxpayers.

The first group of Americans does not pay a lot of attention to this whole income tax thing. These people are, if not tax-eaters, getting money redistributed from other Americans via the income tax, along with other ways, or at least not paying in anything significant. Hey, I don't say they deserve to pay more (in fact I'd like to see the lowest bracket go up to $50,000 in today's money), but they also don't have as much reason to care how it's spent, either.

You are going to tend to not worry about the US Gov't spending a $100 billion here, a $100 billion there, even for things you know to be stupid, if you have no skin in the game.

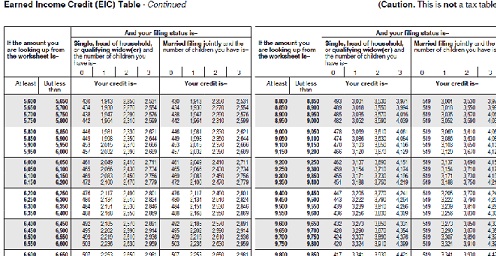

Then, there's the lower middle class. They (if they save the money on accountants or software and spend an hour or two downloading/printing/filling-out) will see the tax tables below:

The tax payments due are based on income after all deductions/credits.

When you are already paying 22% (lower by 3 points over 2017 - thanks a little, President Trump), on any money earned over ~ $77,000, plus the 10-12% on the money before that, plus 0-10% state income tax, plus the ~ 8% taken out from DOLLAR ONE for medicare and the SS ponzi-scheme** donation you will never get back, you really see how years of your life are taken away. This is a big group of people that really don't have the wherewithal to avoid getting screwed this bad.

I would say, for this group of Americans, especially the ones that actually look at the numbers once in a while, the animosity against the Feral Gov't for taking these years of their labor is pretty intense.

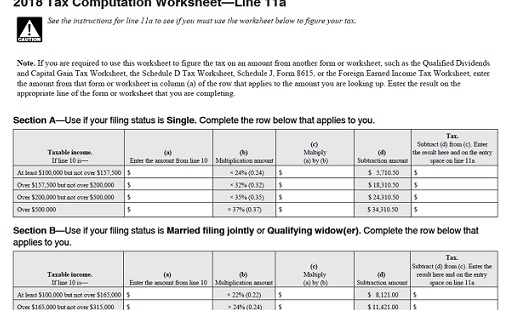

Then, you've got your upper middle class. They may use the simple calculations shown, or their accountants' software will, to figure tax amounts, as the tables only go up to $100,000:

This is done after all the shenanigans performed to avoid higher screwage rates.

Upper middle-class Americans do have the money and the interest in using the myriad complexities of the US Feral Revenue Code to help them lose fewer years of their lives. The thing is, one must still buy property here, or invest in this small business, or sell of this investment and buy this other, etc, etc, to make use of the rules. Some, probably most, of these are things that these tax payers in the high brackets would not normally be particularly interested in doing. It's just shit ya' gotta do, per your accountant, and yes, it does complicate your life. Welcome to tax stupidity, people, we warned you when you moved or were born here!

These folks see the tax code and tax planning finances as a big part of their lives. I wonder if some ever thought of another way, as there's only a few alive to remember it. When you are making well into the 6 figures (not counting right of the decimal point!) it's not like the income tax makes life miserable, but one can see some huge amounts of money going straight to the feds. The complexities in life introduced in order to keep some of that money cause grief for some that I know, as it's almost like an additional part-time job.

At the very high end of this upper middle-class, there are taxpayers who could have influence on local, state, and even federal laws that can not only help, but give an advantage over the next guy. So not all of this group of Americans would even be up for killing the IRS and the horrific fuck-up known as Amendment XVI of the US Constitution.

Then ....:

I mean he just donated 1/2 his money, just to date a 50-y/o bimbo! WTH, man??

The 4th, very-select group of "Americans", if they don't already figure they are World Citizens, are the ones making the laws that will favor whatever it is they are into. They also have plenty of ways to keep their money away from the hands of the IRS, so, no, the IRS and the idea of a tax on Americans' life labor does not concern them. They've got things set up the way they like right now, thank you very much.

* The reader should suspend disbelief here, if these pictures of the forms seem, let's say, antiquated. People want to go all electronic, but I will tell you what: You will learn MUCH BETTER what the system is about (who is being favored, what the incentives are, etc.) if you work out your own forms a few times. It's not hard if you just round off numbers, do math on a napkin and don't sweat the details - that's the IRS's job, provided they do come back to work.... I've got all fingers crossed ...

... hoping they NEVER do!

** Peak Stupidity discussed the Social Security

Comments: