Posted On: Thursday - November 8th 2018 9:09AM MST

In Topics: Global Financial Stupidity

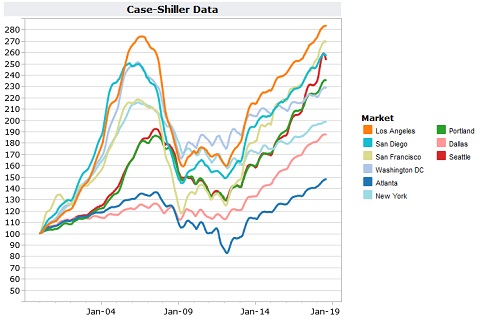

Peak Stupidity's last look at Housing Bubble 2.0, (Extra! Extra! West coast geeks and Chinese to be hardest hit!) was in late June of this year. It's been 5 months, so I wanted to display some data that shows a slight downturn. Keep in mind that the Case-Schiller (2 economists) data, taken from SeattleBubble.com due to the nice interactive graphs they've got, is always 3 months behind. This is August data, presented by "The Tim" (the SeattleBubble blogger) near the end of the month 2 months later, as usual. I look forward to seeing the new data near the end of each month, and here is the latest for all the west coast big cities, and then some representative ones around the country:

Seattle itself seems to have had the only real downturn in housing prices, but the others seem to be leveling off. See the data is for August, which is normally still in the rising period of the yearly cycles in the residential real estate business. It may not be much, and, by definition, a bubble is something that does not decrease in size SLOWLY. The reason for some of the financial stupidity existing in bubble form is that the causes, the moral hazards, that is, which start these processes, stay in place while the psychology of investors becomes "this will never end" or "I'm gonna get my share of this, no matter how stupid the prices always seemed." At some point a few people get wise early that this game of musical chairs will end, and yes, the music will stop. Things fall apart once too many people get wind of this wisdom.

This bubble is housing prices, especially in the west, is driven more by Chinese money, rather than just the psychology of version 1.0 in the mid '00's. I don't think these Chinese folks will run out of money anytime soon, but again, it just takes a few wise ones that think "hey, I can store my money this way, but I don't want to lose 50% of it in some kind of crash." Well, the more of them that think a crash is coming, the more quickly a crash WILL be coming.

We shall see. I'm just a spectator, not a speculator, in all this. Feels good - nothing to lose, nothing to gain. No, I don't want to gain easy money. It doesn't thrill me ... just weird that way, I guess.

PS: I'll repeat this again regarding the Case-Schiller numbers, as otherwise the reader's interpretation will likely be off. These numbers, indices actually, cannot be compared to each other as a comparison of prices, only a comparison of how each city's median house prices have risen/fallen from their values in the year 2000. A 200 in Los Angeles means the prices are 2 x the LA prices in the year-2000. A 200 in Atlanta means the same for Atlanta, but not that house prices in Atlanta = house prices in LA.

Comments: