Posted On: Saturday - September 1st 2018 4:28PM MST

In Topics: History Economics Inflation

(... continued directly from previous post.)

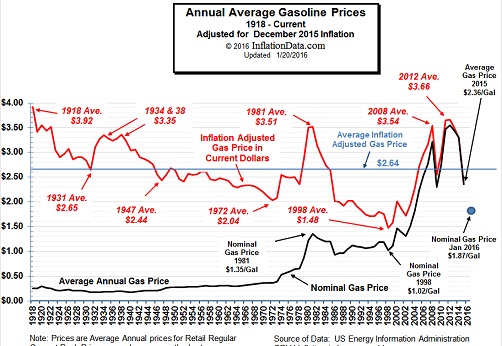

Early 1980's steady decline: It was a man named Paul Volcker, who had been appointed to as President of the FED by President Carter who is the one responsible for getting inflation, including that in oil prices under control. Keep in mind, the FED and removal of dollar from the gold standard are the CAUSES of inflation. Peak Stupidity has no love for the FED. It's just that Mr. Volcker forced or let interest rates go way up to their natural level for the high inflation. This was what slowly and surely brought inflation down through the 1980's.

I first saw gasoline prices get down below a dollar on a trip to Florida where it's cheap (low taxes and possibly good distribution). That was in 1982.

Mid-1980's through End-of-1990's stability: This is one discrepancy between the graph above and my memory. It wasn't just my location as I started to to get around, everywhere. Gasoline stayed stable below a dollar for a decade and a half, with a slight bump during the Gulf War year 1990-1991. I was on a long drive headed across west Texas. You don't just wait until 1/8 of a tank to pull in for a fill-up in the desert. As I pulled up, I saw $1.15 or so. OMG! (We didn't write it like that then.) That was a bad spot, I figured and got 3 or 4 gallons just to get me to a more reasonable spot for gas. Well, the next one 100 miles away was higher than that! What I hadn't think about, until then, was that prices were rising not with location, but time. This was during the build-up to war in the Middle East, and prices were rising faster than I could drive! ... or something like that.

Anecdote aside, this period was in general one of very stable prices, Inflation slowly headed down toward a very low (REAL) number by the mid-'90's, something I'll discuss more in a post about inflation and China. I don't think there was a reason to talk about the politics behind oil production for that long while, with that Gulf War exception.

Early 2000's big steady rise: It was not until 1998 when I bought gas above one dollar again, and that was in an expensive location. From then on, it just kept on a slow, steady rise, going through 2 bucks by 2005 or so, then through $3, $4, sky's the limit on through 2008. The graphs are off on this too. I was there in summer of 2008 when, even in my fairly low-cost locale, you felt like you were stealing gas when the sign showed $4.19 (and don't forget the 0.9¢!). California had prices over $5. Is it that the graphs show prices before tax? That'd explain things.

2008 price crash: When the price crashed down from over $4 to $1.70 or so, I told a friend about my idea about his brother (a trucker) buying one of those 8,000 gallon transport trailers just to store us a bunch. I knew (but was wrong) that it would bump right back up to >$3 soon enough. Well, yeah, there's stabilizer, care of the trailer for later sale.... nah, but it was a thought though.

2010's era of stability: We've had it pretty good. With the exception of a decent bump-up in 2012, I've seen the gas between $2.15 and $2.65 for years now.

I have only one important point to make after all this possibly mind-numbing memory dump. Remember that I wrote in the last post that one could get a gallon of gasoline for 2 or 3 silver dimes, well for 2 or 3 of ANY dimes. Now, if one ran into a counter-clerk inside the station who a) could speak English and b) understands the value of real money,... hahahaaa ... OK, not bloody likely... Just say that you did. 2 or 3 pre-1965 dimes which contain mostly silver* would still buy you that 1 gallon of gasoline.

Let me give a few details on that last bit: The cool thing with that old silver money was that the silver amount was linear with face value (denomination). They all have 90% silver and because the weights of those 1964-and-earlier dimes, quarters, 1/2 dollars, and dollars were made linear with denomination, the silver amount is too. Lastly, except for the Morgan and Peace dollars, the 1 dollar coin weighs in at ~ .8 tr-oz, 1 dollar in face value results in 0.72 tr-oz of silver. Therefore, at a mid-range of the fairly stable $14 - $18/oz spot price of silver, 2 dimes, or 20¢, has 0.144 tr-oz, of it, which fetches $2.30 in our fiat dollars, enough to buy, HEY!, yes, 1 gallon of gas.

Does that last part have anything to say about what is REAL MONEY and what are just pieces of green paper? Indubitably, it does!

(I've still got a few more things, as a summary, to say about the interesting history of gas prices, at the risk of losing a reader or two. I'll put that up next week. Top priority!)

Comments: