Posted On: Wednesday - June 30th 2021 4:51PM MST

In Topics: Economics Big-Biz Stupidity Scams

(Continued from previous post.)

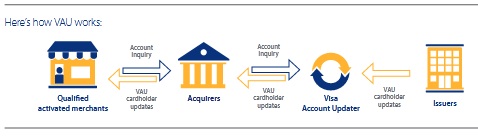

It's not so easy to find out information on the operation of this Visa Account Updater system, but I'm almost positive it's run by Visa itself. When doing searches on this subject most of the results are pages on credit union sites with information for their customers. I really wonder how many Americans know about this system other than those who've already had to deal with it based on some problems like ours. Americans are pretty savvy consumers - well, when it's our OWN MONEY - and "we" consume a whole lot. I think word on this will get around.

BTW, I assume by "Visa" they mean this applies to MasterCard, or are there even MasterCards at all anymore? American Express has its own deal called Card Refresher that does the same thing. There is one difference I see right away with it, which I'll get to later on.

Here's how this thing must have started: Americans use the hell out of these credit cards. Additionally, as I wrote about last time, many merchants with products for sale like to arrange recurring payments. This way, Americans can more easily live paycheck-to-paycheck which, unfortunately, seems to be the preference for most, and there's that almighty convenience factor* too. Then, as noted last post and in the comments there too, there's the huge amount of scamming going on, resulting in credit cards and debit cards being canceled more often. That has been happening in our household lots lately, perhaps averaging 3 times yearly lately.** I used to go with a debit card that simply wore out.

I'm sure lots of Americans with all those recurring payments have lots of instances of either canceled service or late payments due to the company on the other end not able to get their money regularly. Then there's a complaint or a call to beg for or demand satisfaction from the CC company. I put the blame mostly on these customers, with, of course, the contributing factor of getting into these situations due to the incessant scamming.

When a charge is disputed by a customer, the way it goes, it's usually the CC company that decides to cancel, or at least strongly recommends canceling of, the card number. When the scamming is more regular, urgent, or annoying, there's one good option for the customer to stop the theft of his money - cancel the card, prontomundo. Not all the scamming is blatant There may be a disagreement resulting in an unsatisfactory conversation with "customer care". One can try to hash it out, or one can just hang up and cancel the card to JUST END IT. That is the leverage we had and thought we still have.

Therefore, there was motivation for all three parties here. For the consumers, it's having lives too complicated to keep the card numbers all up with all their creditors, getting burned by fees or lost service. The motivation for the card-issuing companies is that they have had to deal with complaints from consumers about the late fees and interactions with, and complaints from, the merchants about charges they can't collect. The merchants had a big motivation for this too, as they had to deal with lots of missing payments monthly, some to be recouped later and with late fees added, and some they had to eat. The impetus to set up this Visa Account Updater could have come from any of the 3 or a combination thereof.

They got this thing up and running. Who knew? Seriously, who has heard about it? You think you cut off the flow of the money to that alleged auto warranty service, but, whoa, next month, there it goes again!

The good for a consumer that has come from the Visa Account Updater service is that, after another unsettled dispute, or another scam is settled with the solution being another card cancellation, he doesn't have to update all his merchants or servicers(?) right away or get charged extra fees. The card issuer saves on the time dealing with complaints from both sides. The merchant or company providing a service comes out the best . Now he doesn't have to deal with complaints on said late charges (well, maybe they are actually a "profit center") and can be more confident in those receivables coming in every month. What if he's not on the up-and-up? He comes out ahead too! Win/win/win/win?

The bad aspect for the consumer is simple. His main leverage, "I'll cancel the card", is now gone. The bad news for the CC issuers is ... hmmm... nothing. Big Biz usually comes out pretty well for itself. However, I'm not completely sure about that, as they may end up with more work in the charging disputes departments. How's it going to be when many a customer can't end the money drain from some outfit, legit or not, and must call continually for months to "claw back" (as they say) the money? One Philadelphia lady tells her experience here that involves getting

The merchants have to love this new system. An example would be the Uber driver and/or Uber itself, as mentioned in the postscript of the previous post. Lastly, oh, yeah, those scammers have got to love it.

Back to our particular story now, yes, as the customer, you can opt out. That's what I did after getting the scoop, and the first thing I'd ever heard about, the Visa Account Updater. The American Express site linked to above says you need to apply to opt IN. I like that better. Maybe my wife did, without knowing anything about it, but then she applied for this card at least 5 years ago. I don't think this deal was around then, simply because one's payments WOULD be cut off to a customer if the card were canceled.

I realize that the Peak Stupidity readers are going to be on the savvier side of this consumer stuff, but I'll put my "advice to consumers" here anyway:

1) Don't set up any more monthly automatic recurring payments than you have to.

(2) If you ignore (1), decide if it's easier for you to continually make the effort to keep current CC numbers available to all those people charging you legitimately as you keep your leverage to cut the scammers off or easier for you to just fight all those charges, but not have to worry about the legitimate payments getting made.

3) Gold, Bitchez!

* It does take a dollar each month for each of the regular bills, unless I trust the outfit enough to pay ahead. Stamps are in the neighborhood of 50¢ and checks cost about 50¢. apiece. (I do know you can make up your own checks, or at least used to be able to. So far, that's not worth the effort.)

** One of these instances was an exact $150 one-time charge from that Venmo outfit. First of all, I don't usually make payments on round numbers like that, and then I didn't recognize that lame-ass internet-style name. Sure enough, people had been scammed to use Venmo before, per the bank, and the dispute was quickly settle for me. I noted that this charge was incurred one day after I stayed at a •Indian-run motel. Coincidence? I'd be generous to think that.

Comments:

Moderator

Thursday - July 1st 2021 3:22PM MST

PS: Ha, Adam, my wife was pulling some deal like that (I almost wrote "scam") with amazon and their Prime service. Sign up, get a bunch of stuff for just under a month, cancel it... repeat. She may deserve that occasional scam charge as karma. (No, she doesn't read here, haha!)

What you're doing seems fair enough, as they want to reward those who autopay. That is 5%, but the phone company charges you more like 10-15% to pay when you damn well thing the money is due.

Yeah, I guess you can tell when it'd be better not to hand that card over to a clerk at least. At that hotel, you've got to give them a card, even if you want to pay cash. That just reminded me of a time the guy (it wasn't a hotel) wanted to write down the card number, expiration date, and get this, the security code on the back. Fuck that shit, is what I told him.

What you're doing seems fair enough, as they want to reward those who autopay. That is 5%, but the phone company charges you more like 10-15% to pay when you damn well thing the money is due.

Yeah, I guess you can tell when it'd be better not to hand that card over to a clerk at least. At that hotel, you've got to give them a card, even if you want to pay cash. That just reminded me of a time the guy (it wasn't a hotel) wanted to write down the card number, expiration date, and get this, the security code on the back. Fuck that shit, is what I told him.

The Alarmist

Thursday - July 1st 2021 12:08PM MST

PS

I have a couple Mastercards, so they must be real.

The interesting thing is that the default payment arrangement for my Euro Mastercards is to pay off in full each month, while the US issuers only ask for a minimum amount each month to allow them to reap big money on revolvers. I could prefer to revolve in Europe, but the banks seem content to not up their risk to individuals and are ok with just the fees.

I absolutely avoid subscription or repetitive charges on my cards like the plague. As for my personal mobile, I’m happy to go with the flat-rate €9.99 plan that I top up with store-bought vouchers. I keep the bare minimum on the account, so that when I’m in the US, there isn’t enough on the account to allow for auto-renewal, and I top up when I hit the ground in the EU, meaning I didn’t pay for the two or three weeks I was away. I am somewhat amused at how expensive US mobile plans have gotten. People line up for miles at food banks, but they all seem to have smartphones and they keep the engine running for the A/C ... makes one go hmmm.

I have a couple Mastercards, so they must be real.

The interesting thing is that the default payment arrangement for my Euro Mastercards is to pay off in full each month, while the US issuers only ask for a minimum amount each month to allow them to reap big money on revolvers. I could prefer to revolve in Europe, but the banks seem content to not up their risk to individuals and are ok with just the fees.

I absolutely avoid subscription or repetitive charges on my cards like the plague. As for my personal mobile, I’m happy to go with the flat-rate €9.99 plan that I top up with store-bought vouchers. I keep the bare minimum on the account, so that when I’m in the US, there isn’t enough on the account to allow for auto-renewal, and I top up when I hit the ground in the EU, meaning I didn’t pay for the two or three weeks I was away. I am somewhat amused at how expensive US mobile plans have gotten. People line up for miles at food banks, but they all seem to have smartphones and they keep the engine running for the A/C ... makes one go hmmm.

Adam Smith

Thursday - July 1st 2021 7:41AM MST

PS: Good morning Mr. Moderator...

“are there even MasterCards at all anymore?”

Evidently, yes. Mastercard has 21,000 employees and $15 billion in annual revenue.

They even have their own automatic billing updater...

https://www.mastercard.us/content/dam/public/mastercardcom/na/us/en/documents/Mastercard-Automatic-Billing-Updater-Merchant-Global-2017.pdf

The only “automatic recurring payment” thing I do is when I buy cat food from chewy. They give me 5% off if I use what they call “Autoship”. I set it up for 8 months which is the longest autoship interval available in their drop down menu. Then, next time I make an order I cancel that autoship and add whatever I like to my cart and then hit autoship again for the new order and sign up for another 8 months out. I only save a few bucks each order doing this, but it's been working pretty well.

Oh, and Netflix charges our card every month. No other automatic recurring payment things here. The electricity, insurance, credit card and internet bills come in the mail. I could pay the electricity and internet in cash and the others with a check in the mail if I wished but it's easier to do bill pay though the bank's website. Everything else is handled by cash (mostly) or check.

I think using cash whenever possible keeps your card's digits out of the merchant's databases (and away from possible rfid card readers) making one less likely to be scammed. It also helps preserve your privacy.

☮

“are there even MasterCards at all anymore?”

Evidently, yes. Mastercard has 21,000 employees and $15 billion in annual revenue.

They even have their own automatic billing updater...

https://www.mastercard.us/content/dam/public/mastercardcom/na/us/en/documents/Mastercard-Automatic-Billing-Updater-Merchant-Global-2017.pdf

The only “automatic recurring payment” thing I do is when I buy cat food from chewy. They give me 5% off if I use what they call “Autoship”. I set it up for 8 months which is the longest autoship interval available in their drop down menu. Then, next time I make an order I cancel that autoship and add whatever I like to my cart and then hit autoship again for the new order and sign up for another 8 months out. I only save a few bucks each order doing this, but it's been working pretty well.

Oh, and Netflix charges our card every month. No other automatic recurring payment things here. The electricity, insurance, credit card and internet bills come in the mail. I could pay the electricity and internet in cash and the others with a check in the mail if I wished but it's easier to do bill pay though the bank's website. Everything else is handled by cash (mostly) or check.

I think using cash whenever possible keeps your card's digits out of the merchant's databases (and away from possible rfid card readers) making one less likely to be scammed. It also helps preserve your privacy.

☮

Alarmist, Americans are probably just more unthinking when it comes to monetary priorities. I wrote a post on this, that people will make fun of you if you check prices on everything. I mean, I used to not buy anything, not even a piece of gum, without at least wanting the price first. Lots of Americans seem to think that's gauche or cheap or something.

On our one card that is an actual credit card, we tried to avoid both the interest and the fees. We are very careful about the interest, so don't pay any, but some small fees come up out of some corporate marketer's ass, no matter that they told you that there were to be no fees.