Posted On: Tuesday - April 28th 2020 7:22PM MST

In Topics: Economics US Feral Government

I knew there was something else I'd meant to add in our 2nd post on income tax withholding. This post will be a quick addition to Income Tax Withholding - flattening the pain, damage, and awareness curves and Tax withholding and Leverage.

I really couldn't believe this crap when I first heard of it, in reference to some kind of special tax credit a few years back to incentivize Americans to do something or other. In case you don't care to keep track of any this complicated method of theft, here's a very quick point:

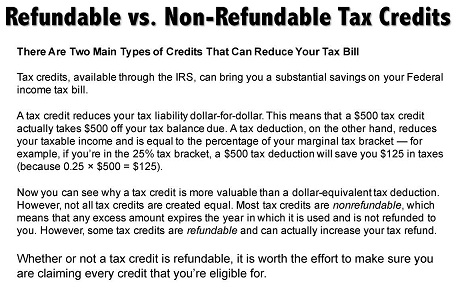

A tax credit is a direct subtraction off of the bottom line, tax owed. This is as opposed to a deduction which is taken off the top line (well near the top, at least), the income earned. The latter is only worth whatever your marginal rate is (the highest bracket your income level comes under) x that deduction. I.e., if you are earning an amount that gives you a marginal tax rate of 22%, then a $1,000 deduction saves $220 on your tax bill, while a $1,000 credit saves you $1,000.

OK, fine. My point here is about a type of credit called a non-refundable one versus a refundable one.

Funny, that web page is very helpful, with lots of talk about your doing the best thing to save money. Should the IRS be doing this? If you don't care about collecting the most money, guys, quit auditing us minor cheaters!

Yes, you read that right! There are credits for which you may be fully eligible, but will not get, because you don't owe the IRS money on April 15th (extendable during Panic-Fests) to subtract if from. Really, WTF?! This is real, and they are called "non-refundable". That term is usually used in a different manner - in this case it means the credit doesn't apply to people getting tax refunds.. I'd thought I'd just misunderstood back when there was the special credit I can't remember.

Just to make this perfectly clear: If there is a $2,000 non-refundable credit that you meet the criterion for, yet you have 5 bucks coming to you, you get nada, nunca, nilch, other than that 5 bucks. If you owe the IRS 5 bucks, you will be relieved of that burden, and if you owe 1,000 bucks, you'll be relieved of it. If you owe $2,000 or higher, you subtract that $2,000 credit from what you owe, in the way that a credit is supposed to work.

Some new tax deal could be passed in the middle of the fiscal year. (No, nobody seems to give a damn about that stuff about retro-activity anymore.) Your best bet, if you are eligible for it, is to go submit a new W-4 withholding form with a high number of exemptions. Make damn sure you're going to owe for that year, and enough to get you the whole credit.

Do you see this possibly most important reason not to have tax refunds coming each year? Please let me know, readers, if I have missed anything. Otherwise, yeah, how would you feel being the sucker?

Comments:

Moderator

Wednesday - April 29th 2020 12:21PM MST

PS: Mr. Blanc, I don't mean EE Credit (for those who make a very meager amount of income), but how about child credit or some such thing that has been around a good while? In my case, I meant one of these fad things, like solar panel installation, though it wasn't that.

There's some fad that Congress will decide to encourage once in a while, and that's what I mean. Dang, I wish I could remember the one - maybe it was some crap during the Obama admin. about junk cars, but then, wait, I keep junk cars, so that's not it.

Possibly by "aware" you just meant that it could have been the case that you got some break sometime - I do my own taxes and have always (life's not too complicated), so I keep up with the basics. I'm no accountant though or tax guy ...

There's some fad that Congress will decide to encourage once in a while, and that's what I mean. Dang, I wish I could remember the one - maybe it was some crap during the Obama admin. about junk cars, but then, wait, I keep junk cars, so that's not it.

Possibly by "aware" you just meant that it could have been the case that you got some break sometime - I do my own taxes and have always (life's not too complicated), so I keep up with the basics. I'm no accountant though or tax guy ...

MBlanc46

Wednesday - April 29th 2020 11:15AM MST

PS I’m not aware of having ever been eligible for a tax credit.

Moderator

Wednesday - April 29th 2020 9:32AM MST

PS: "Failure to voluntarily comply may result in imprisonment, fines, and penalties." LOL! Great comment, thank you.

Adam Smith

Wednesday - April 29th 2020 7:54AM MST

PS:Howdy Mr. Moderator,

Officially, the U.S. income tax system is based on voluntary compliance. "Voluntary compliance" is the cornerstone of the tax system. Failure to voluntarily comply may result in imprisonment, fines, and penalties.

https://www.c-span.org/video/?c4455340/user-clip-irs-head-steve-miller-admits-income-taxes-voluntary

Legalese is a language that sounds like english, made of words that have very different meanings than the words they sound like and are spelled the same as.

https://scholarship.law.upenn.edu/cgi/viewcontent.cgi?article=1154&context=penn_law_review_online

Officially, the U.S. income tax system is based on voluntary compliance. "Voluntary compliance" is the cornerstone of the tax system. Failure to voluntarily comply may result in imprisonment, fines, and penalties.

https://www.c-span.org/video/?c4455340/user-clip-irs-head-steve-miller-admits-income-taxes-voluntary

Legalese is a language that sounds like english, made of words that have very different meanings than the words they sound like and are spelled the same as.

https://scholarship.law.upenn.edu/cgi/viewcontent.cgi?article=1154&context=penn_law_review_online

Wish I could claim that sentence as my own... But...

"Failure to voluntarily comply may result in imprisonment, fines, and penalties." was plucked from...

https://www.irs.gov/compliance/criminal-investigation/irs-criminal-investigation-voluntary-disclosure-practice

Since there is so much misinformation about the nature of the tax system...

Here is another fun quote from the IRS

"The Social Security Act does not require a person to have a Social Security number (SSN) to live and work in the United States, nor does it require an SSN simply for the purpose of having one."