Posted On: Saturday - August 19th 2023 11:42AM MST

In Topics: Global Financial Stupidity Economics US Feral Government The Future Taxes

It's staaaartingggg! [points finger at the screen like little Heather O'Rourke in Poltergeist]

Peak Stupidity has pointed out the US budget financial doom coming as soon as interest rates rise out of the

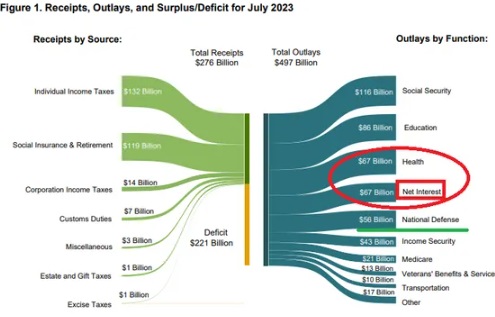

The snapshot is above isn't in the pie chart form. I don't know what you call this kind of graph. It's easily interpretable, as was a similar type we showed in this post about having perspective on slavery, used to show spatial relationships too.

It was not me but one Daniel Horowitz of The Blaze who circled and pointed out that $67 Billion monthly net interest payment in his article Record Debt and Inflation from the Rich Men North of Richmond. This was the July US national budget picture.

What looks really horrible is the difference between tax receipts and outlays, with only 58% of the outlays being covered. I am not sure if that is a somewhat seasonal artifact though. Income tax withholding is very regular, and then there are quarterly payments made by the more well-off and by corporations - there are deadlines, but the payment periods cover the year evenly. The period of mid-January through mid-April is one in which there must be a lot of money going both directions as far as individual taxpayers (and taxeaters) are concerned.

That aside, one can calculate that July's net interest paid out was 13.5% of the monetary outlays. From the looks of the categories, special Ukraine payments due aside, the rest doesn't look very seasonal. July may not be anything special as far as interest payments go - they are going up as rates go up. Even so, that $67 Billion monthly payment on a debt of $32 Trillion is still at an average annual rate of only 2.5%! (I didn't count compounding.) As the article states among its many personal-level economic doom bullet points later on in the article*, home interest rates are averaging 7.5% now. Even low, low Treasury bond rates must be generally increasing from that 2.5%. I was just going to present this graph, but Mr. Horowitz is scarier than a poltergeist here:

According to the Treasury Department, for the first time ever, spending on interest on the debt not only surpassed military spending in July but tied the cost of our health care leviathan! At $67 billion, the cost of servicing our debt was eclipsed only by Social Security and education (because of student loans) and was 20% costlier than national defense. Put another way, more than 50% of all tax revenue collected from all payroll taxes of all U.S. workers went toward interest on the debt. Headed forward, assuming interest rates aren’t forced up even higher, we will pay an annualized rate of $1 trillion in interest on the debt of government programs and functions that shouldn’t exist even if they were free.That's what I've been saying was coming. It's here!

* ... which are probably a subject for another post.

Comments:

Mr. Anon

Tuesday - August 22nd 2023 8:20PM MST

PS

"What looks really horrible is the difference between tax receipts and outlays, with only 58% of the outlays being covered. I am not sure if that is a somewhat seasonal artifact though. Income tax withholding is very regular, and then there are quarterly payments made by the more well-off and by corporations - there are deadlines, but the payment periods cover the year evenly."

Quarterly self-employment taxes were due on June 15th, and presumably wouldn't be covered by this figure. Or would they? When do the feds deposit the checks? I don't know. But it would be interesting to compare this to the comparable figure for June. Perhaps the tax receipts would be somewhat more in-line with the outlays.

Regardless, the federal government is clearly spending beyond our means.

"What looks really horrible is the difference between tax receipts and outlays, with only 58% of the outlays being covered. I am not sure if that is a somewhat seasonal artifact though. Income tax withholding is very regular, and then there are quarterly payments made by the more well-off and by corporations - there are deadlines, but the payment periods cover the year evenly."

Quarterly self-employment taxes were due on June 15th, and presumably wouldn't be covered by this figure. Or would they? When do the feds deposit the checks? I don't know. But it would be interesting to compare this to the comparable figure for June. Perhaps the tax receipts would be somewhat more in-line with the outlays.

Regardless, the federal government is clearly spending beyond our means.

Adam Smith

Monday - August 21st 2023 10:48PM MST

PS: Greetings Bill...

Many thanks for the new (to me) information...

I never knew that the cali constitution prohibited borrowing or incurring debt (beyond $300,000 dollar bucks without the consent of the tax cattle.) to be a thing...

It's pretty wild that the "state of California" can incur a debt of ~$520 Billion (with a B) debt while pretending that they cannot (by law) run any sort of "deficit".

I wish there were a way that us average normal people could hold the people masquerading as "government" accountable for their failure(s) to uphold the so called law and the so called constitution...

...

We are "blessed" to live in interesting times...

I hope you have a great evening!, Bill!

Cheers!

☮

Many thanks for the new (to me) information...

I never knew that the cali constitution prohibited borrowing or incurring debt (beyond $300,000 dollar bucks without the consent of the tax cattle.) to be a thing...

It's pretty wild that the "state of California" can incur a debt of ~$520 Billion (with a B) debt while pretending that they cannot (by law) run any sort of "deficit".

I wish there were a way that us average normal people could hold the people masquerading as "government" accountable for their failure(s) to uphold the so called law and the so called constitution...

...

We are "blessed" to live in interesting times...

I hope you have a great evening!, Bill!

Cheers!

☮

Bill H

Monday - August 21st 2023 7:41AM MST

PS @Adam Smith

California's constitution prohibits debt, but somehow we keep running deficit budgets. I've never figured out how we do that, but the media reports the deficit while saying at the same time that the state is not allowed to incur debt.

California's constitution prohibits debt, but somehow we keep running deficit budgets. I've never figured out how we do that, but the media reports the deficit while saying at the same time that the state is not allowed to incur debt.

Moderator

Sunday - August 20th 2023 5:11PM MST

PS: I wonder what Dean Baker would have to say now, Bill.

Regarding your 2nd point to Dean Baker, there's more to it. If you cut immigration and deport, for example, that labor shortage will cause wage increases, but you'd have to consider tariffs too (for some businesses), as otherwise it all goes away.

Adam, yes, Ron Paul turned 88. What a great American!

I agree about all that other debt too. There's not getting out of this without major financial pain.

Even regarding Federal expenditures, there are the "unfunded obligations", pensions and such, for which the numbers just don't pan out. There's no way the money that people expect to get can be paid. That is, at least in REAL dollars. (Sure, you'll get your $2,200/ mo. SS checks, as promised. Granted, a one bedroom apt. on the outside of town rents for $1,800 now, and a Big Mac meal goes for $19.99.)

Those unfunded obligations are said to be $100 or $200 Trillion, much higher than the regular on-budget debt.

I gotta say, it's not like I couldn't see some of the problems, but the ZeroHedge of 12 years back or so really opened my eyes on this stuff.

Regarding your 2nd point to Dean Baker, there's more to it. If you cut immigration and deport, for example, that labor shortage will cause wage increases, but you'd have to consider tariffs too (for some businesses), as otherwise it all goes away.

Adam, yes, Ron Paul turned 88. What a great American!

I agree about all that other debt too. There's not getting out of this without major financial pain.

Even regarding Federal expenditures, there are the "unfunded obligations", pensions and such, for which the numbers just don't pan out. There's no way the money that people expect to get can be paid. That is, at least in REAL dollars. (Sure, you'll get your $2,200/ mo. SS checks, as promised. Granted, a one bedroom apt. on the outside of town rents for $1,800 now, and a Big Mac meal goes for $19.99.)

Those unfunded obligations are said to be $100 or $200 Trillion, much higher than the regular on-budget debt.

I gotta say, it's not like I couldn't see some of the problems, but the ZeroHedge of 12 years back or so really opened my eyes on this stuff.

Adam Smith

Sunday - August 20th 2023 10:25AM MST

PS: Kinda on topic...

Happy Birthday Ron Paul!

☮

Happy Birthday Ron Paul!

☮

Adam Smith

Sunday - August 20th 2023 9:21AM MST

PS: Good afternoon, everyone,

❞𝐌𝐨𝐫𝐞 𝐭𝐡𝐚𝐧 𝟓𝟎% 𝐨𝐟 𝐚𝐥𝐥 𝐭𝐚𝐱 𝐫𝐞𝐯𝐞𝐧𝐮𝐞 𝐜𝐨𝐥𝐥𝐞𝐜𝐭𝐞𝐝 𝐟𝐫𝐨𝐦 𝐚𝐥𝐥 𝐩𝐚𝐲𝐫𝐨𝐥𝐥 𝐭𝐚𝐱𝐞𝐬 𝐨𝐟 𝐚𝐥𝐥 𝐔.𝐒. 𝐰𝐨𝐫𝐤𝐞𝐫𝐬 𝐰𝐞𝐧𝐭 𝐭𝐨𝐰𝐚𝐫𝐝 𝐢𝐧𝐭𝐞𝐫𝐞𝐬𝐭 𝐨𝐧 𝐭𝐡𝐞 𝐝𝐞𝐛𝐭.❞

Sounds like a good way to enslave a formerly free, formerly prosperous people. And this is just the federal debt. This does not include the debt taken on by cities, states, counties, towns, villages, water conservation districts, school districts, etc. ad nauseam.

The people masquerading as "government" should not be allowed to deal in debt. These criminals really need their credit cut off.

☮

❞𝐌𝐨𝐫𝐞 𝐭𝐡𝐚𝐧 𝟓𝟎% 𝐨𝐟 𝐚𝐥𝐥 𝐭𝐚𝐱 𝐫𝐞𝐯𝐞𝐧𝐮𝐞 𝐜𝐨𝐥𝐥𝐞𝐜𝐭𝐞𝐝 𝐟𝐫𝐨𝐦 𝐚𝐥𝐥 𝐩𝐚𝐲𝐫𝐨𝐥𝐥 𝐭𝐚𝐱𝐞𝐬 𝐨𝐟 𝐚𝐥𝐥 𝐔.𝐒. 𝐰𝐨𝐫𝐤𝐞𝐫𝐬 𝐰𝐞𝐧𝐭 𝐭𝐨𝐰𝐚𝐫𝐝 𝐢𝐧𝐭𝐞𝐫𝐞𝐬𝐭 𝐨𝐧 𝐭𝐡𝐞 𝐝𝐞𝐛𝐭.❞

Sounds like a good way to enslave a formerly free, formerly prosperous people. And this is just the federal debt. This does not include the debt taken on by cities, states, counties, towns, villages, water conservation districts, school districts, etc. ad nauseam.

The people masquerading as "government" should not be allowed to deal in debt. These criminals really need their credit cut off.

☮

Bill H

Sunday - August 20th 2023 7:06AM MST

PS I once tried an exchange with the indomitable Dean Baker, who writes nationally for some big think tank, on what would happen if interest rates rose even slightly, and he was contemptuous. "Who would raise those rates?" he asked me. I suggested that the Fed not only could, but would have to at some point, and he called me an idiot.

He also claimed that there was no labor shortage because a business could simply hire workers away from the competitor by paying higher wages. Higher wages are his answer for everything. I tried to tell him that doing that merely moved the shortage from one business to another and he called me an idiot.

He also claimed that there was no labor shortage because a business could simply hire workers away from the competitor by paying higher wages. Higher wages are his answer for everything. I tried to tell him that doing that merely moved the shortage from one business to another and he called me an idiot.

Moderator

Sunday - August 20th 2023 6:10AM MST

PS: "Must be reversed" Surely he's got a quantitative plan, right? Ha.

Yes, it's gone down to TS, but isn't it Cat 1 again? I will check and give Steve Sailer a heads up. I'm not sure how far above sea level is his closet.

Yes, it's gone down to TS, but isn't it Cat 1 again? I will check and give Steve Sailer a heads up. I'm not sure how far above sea level is his closet.

SafeNow

Sunday - August 20th 2023 5:09AM MST

PS

The linked article ends: “It is exactly the system that must be reversed if we hope to own anything of value in the future.” I take it that means either reduce outlays, or, inflate-away obligations, and sorry, asset values get reduced in the process. That’s not a quantified prediction. I am in S. Cal following the hurricane Hillary predictive maps. I especially love the “spaghetti models.” I would love to see a spaghetti model in which strands predict the possible ways this economic time bomb will resolve. The thickness of a spaghetti strand would depict the likelihood of that strand happening. Steve Sailer says “they want my equity.” Well, does that get many strands, and are they thick? I am weak in economics and related graphs, but isn’t there some sort of graph that quantifies the various possibilities about what the heck is going to happen.

The linked article ends: “It is exactly the system that must be reversed if we hope to own anything of value in the future.” I take it that means either reduce outlays, or, inflate-away obligations, and sorry, asset values get reduced in the process. That’s not a quantified prediction. I am in S. Cal following the hurricane Hillary predictive maps. I especially love the “spaghetti models.” I would love to see a spaghetti model in which strands predict the possible ways this economic time bomb will resolve. The thickness of a spaghetti strand would depict the likelihood of that strand happening. Steve Sailer says “they want my equity.” Well, does that get many strands, and are they thick? I am weak in economics and related graphs, but isn’t there some sort of graph that quantifies the various possibilities about what the heck is going to happen.

Of course, duh! I didn't think of this first, but most would surely wait until the last minute for a few reasons: Interest or time value of money (when there is any - this is changing), spite, etc ...