Posted On: Friday - August 4th 2023 7:57PM MST

In Topics: Global Financial Stupidity US Feral Government Taxes

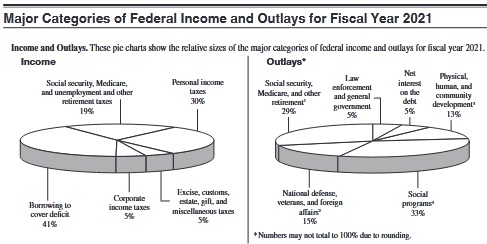

It's not quite a yearly thing, but usually around income tax time, near the cruelest day, Peak Stupidity has been known to display the pair of pie charts that appear near the back of the IRS 1040 Instructions .pdf. Who else reads through the whole thing? (Beats the New York Times, as is the case with cough, cough, some people ...*) They are simplistic, and the categories in the latter are vague, but the 2 pie charges of Tax Revenue and Expenditures, along with the actual totals underneath, give me an idea of these numbers. Most especially I am interested in what looks like a little slice of that pie, the "net interest" being paid.**

Here are previous posts with discussion of these pie charts: Quick glance at the budget from US-Gov crack Green-eyeshade boys (discusses the '15 budget), Comparison of '15/17 US Government Budgets ('15 vs '17), EXTRA, EXTRA, IRS tells all! (in .pdf 1040 Instructions) (with the '19 budget). That's kind of nice, because this we're doing every odd-number year. That was just by chance!

The forms one fills out in April, or when he gets around to it, of '23, are for the '22 tax year, but the year before that seems to be the latest year the IRS can get the numbers for.

Those previous posts have more discussion, but for this post, I want to concentrate only on the 5% slice of pie again. Under the graphs, page 108 of the 1040 Instructions .pdf, 3 numbers are given. Verbatim:

In fiscal year 2021 (which began on October 1, 2020, and ended on September 30, 2021), federal income was $4.047 trillion and outlays were $6.882 trillion, leaving a deficit of $2.775 trillion.Because it's a cute pie chart, there's just one significant digit - 5% - for "net interest", so keep in mind that calculations should be rounded to a number that's good only to 10% (That 5% should mean it's from 4.5% to 5.5%)

That 5% is of the $6.88 Trillion outlay pie, coming to $0.344 Trillion = $344 Billion (we'll round off at the end). That's the numerical value of net interest on the debt paid in '21.

How much debt were "we" paying interest on that year? For total debt, I used numbers from the simple table on this page, one I want to write more about. It says the national budget debt was $29.6 Trillion in '21. I don't know if that was at the beginning or end of the fiscal year. This is just back-o'-the-envelope stuff, so again, I don't care.

"We" (gotta keep putting it in quotes, because I didn't ask for ANY of this shit!) paid $0.344 Trillion on $29.6 Trillion. (We'll finally round here.) That's STILL only a 1.2% rate! Why the exclamation points? I like 'em! OK, it's more than that. Each time Peak Stupidity gets into the financial stupidity*** and interest rates, we go all doomer on the reader, because we think of these pie charts.****

What if the FED quit holding rates in the basement? At 8% interest, that 5% would be a nearly 35% piece of the expenditure pie. It would be an even bigger chunk of the revenue pie, as that one is always smaller (the difference being the annual accumulation of debt, called the deficit). When 50% of all taxes go toward paying interest on the debt - no principle - well, America will look like one of those deadbeat credit card borrowers. We've got 5 cards that we're paying not even the minimum payments on, with daily calls we've got to keep blocking, and a 6th card is in the mail, one we applied for to help us pay off those other 5.

There’ll be a vicious cycle. They can’t seriously cut anything but “Defense” without financially hurting government dependees, which are probably a majority of Americans. The deficits will get that much higher, instead of 20-30% overspending each year, they’ll get to 50% regularly, with no PanicFest of other excuse. Instead of going but 5-10% yearly as now, that total debt will go up by numbers like 20-25%. At constant interest rates, the share of the budget spent on interest will go up to swamp the whole deal.

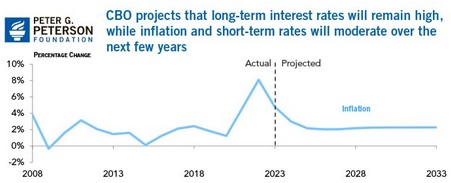

Well, we all know that interest rates HAVE been going up (not left naturally, but done by the FED to try to fight inflation). I will refer you to this comment by the astute Unz Review commenter "Res" right here for commentary on this and another graph. Forget the projections past today, but note that, from a 1-2% range, the long-term interest rates had a spike to 8% in '22. I don't pretend to know exactly how these numbers fit with the Federal Treasury net interest rates but they surely go together.

Why didn't we up and have that crash that Peak Stupidity keeps doomering on about? Well, that 8% interest rate was the top of a narrow spike, for one thing. However, to me, a crash can't NOT happen. I can't say what week or month. When the world sees that this US dollar is not supportable by anything real, there'll be a psychological tipping point. Seeing that we are paying 1/3 or 1/2 of our budget on interest to bondholders and acting like that deadbeat credit card holder I described above may be that point for the finance crowd.

Now that rates are staying at least somewhat higher, will the IRS keep putting that informative pair of pie charts in the back of the 1040 Instructions book? That might scare some people. It still might though, because I don't know who else in the world actually reads the instructions! Actually, I don't either, but I like pie and pie charts.

* That refers, of course to Steve Sailer. In fact, he got 3 posts out of the stupidity contained therein within a day, and his resulting commentary is very entertaining.

** It's not like there are payment coupons and such, but this is about how much is paid out in bond interest, the difference between bonds sold and redeemed, etc. It's complicated. I don't care.

*** We use the Global Financial Stupidity topic key often even on this US budget stuff. It's kind of late to make a another one, this country is still big enough to where a crash here will affect the world, and then, what country can you name in which there isn't a whole lot of financial stupidity these days?

**** There's also a 2nd problem that will occur with natural higher interest rates - the stock market won't be propped up by people with no safe investment options.

Comments:

Adam Smith

Saturday - August 5th 2023 7:08AM MST

PS: Good morning y'all...

I haven't read the post yet, but after looking at the first pie chart (income) I have to ask...

Since when is "borrowing" considered "income"?

What the hell‽ 41% of their "income" is "borrowing to cover the deficit"‽

I'm still a little sleepy eyed, so maybe I'm missing something. But, What the hell‽

Ok (👌), I'm going to go read the post now.

Happy Saturday!

☮

I haven't read the post yet, but after looking at the first pie chart (income) I have to ask...

Since when is "borrowing" considered "income"?

What the hell‽ 41% of their "income" is "borrowing to cover the deficit"‽

I'm still a little sleepy eyed, so maybe I'm missing something. But, What the hell‽

Ok (👌), I'm going to go read the post now.

Happy Saturday!

☮

The Alarmist

Saturday - August 5th 2023 3:47AM MST

PS

Everything is hunky-dory as long as you pay 20% to 30% on those cards while those who don’t need to borrow get to borrow anyway at 3% to buy the assets the little people are defaulting upon while they keep choosing eating and trips to the House of the Devil Mouse for the kiddies over paying down their debt.

Jay Powell is busy teaching Janet Yellen and Larry Fink who’s their daddy.

🕉

Everything is hunky-dory as long as you pay 20% to 30% on those cards while those who don’t need to borrow get to borrow anyway at 3% to buy the assets the little people are defaulting upon while they keep choosing eating and trips to the House of the Devil Mouse for the kiddies over paying down their debt.

Jay Powell is busy teaching Janet Yellen and Larry Fink who’s their daddy.

🕉

Adam, I haven't looked at the left side closely in a couple of years. This is a real conundrum. I mean, my numbers shouldn't change, but are they actually saying that 41% is part of the $4.047 Trillion - they use the same term "income", or is that 41% what makes the 2 pies equal in $.

We gotta look into this more. I better order up a pair of green eyeshades from amazon first...