Posted On: Friday - August 17th 2018 7:36PM MST

In Topics: Global Financial Stupidity Economics US Feral Government Inflation

(continued directly from previous post.)

The amount of additional money poured into the economy via FED creation is what leads to inflation. The increase in prices is the symptom, but economists' definition of "inflation" is inflation of the supply of money. Making pieces of green paper (or more like pressing some keys and putting more zeros on the ends of some numbers stored on a secure server) does not create wealth. Whatever wealth is being created will be the same that day, no matter what the FED "prints". The very simple supply/demand laws says that if there's more money, but the same goods/services out there, then it'll take more money to obtain those goods/services. Sure, sometimes it takes a while for the increase to filter through, and guess what, the US government gets the money first, at it's earlier, higher value.

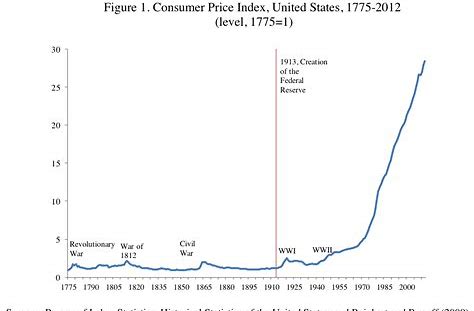

Just look at that graph. For the 1st 125 years of our country, from the first US dollar until the mid-19-teens, inflation was virtually ZERO. Remember the y-axis is just an index representing price level in 1790 as a "1" or some such method. Besides during wartime, the graph is a horizontal line. What changed 100 years ago? Yeah, I know, we just told ya'.. Notice, also, that between the wars in the 19th century prices actually went down. Why would they not, as productivity improved? Most of American history has been a time of great innovation, but the late 1800's were one of the best of these times. If the same amount of money is in use (the money supply), and things take less time and resources to make, then of course prices should go down. What was the deal then, during the 1990-2000's internet ages, when white-collar work got much more productive? I didn't see prices go down. (There was a lull from the mid-90's to mid-00's due to the big shift to China, but that'll discussed in part of another post.)

Prices did not recover the pre-WWII levels after the war, but notice that prices did not go nuts until the mid-1970's. Hmmm, wonder what happened then? There was a coupla' year lag, but since President and Dick Nixon took the country off of the gold standard in 1971 or so, meaning money could no longer be redeemed for it's supposed value in gold*, prices have shot up better than any moon rocket we don't have the money for anymore ever did!

Let's put the two financial evils of inflation and doctored-up interest rates together again. Peak Stupidity has a decent post about this (so please refer to that, if interested (no pun intended)), from 1 1/2 years back, but I'll just try to say this slightly differently. As explained also here interest rates ARE NOT compensation for inflation. If the interest paid on your money in the bank equals the inflation rate, you are going nowhere. You've let that bank have your money to lend out at will, and believe me, they aren't charging basement-level rates. Compensation to you at the rate of inflation is like paying you ZERO for the use of your money! Now, if the FED were not around, and private banks would compete for the use of your money, you could make a decent amount for your services (yes, lending them the money is indeed a service rendered), and I mean a decent rate ABOVE and beyond what inflation is. After all, they are giving you back the money at a lower value, so you should be compensated for that too.

With or without inflation, were interest rates allowed to exist in a free market, then, one could still put some steady savings away and through the "miracle" of compound interest, really make a nest egg. The local bank can do fine giving out 5 % on savings accounts and charging 7% on mortgage loans. However, let's say inflation is running at 4% (quite likely!), and the time value of money is worth 5% annually. The 9% that you SHOULD SEE from the bank is still only really 5% in real value. You're still coming out ahead just the same, as is the bank, but just not as much as it looks. At the same time, you've still got the problem that your wages or income must continually go up, or you won't have the extra to put that same amount of money away yearly. Now, imagine the money supply was left the hell alone, or our currency was backed by something that made it impossible for the money supply to increase (if it did, people would just turn in paper or bits for the real stuff, and turn that currency into trash). Without inflation, such as was the case through still more than 1/2 of the history of America, one could earn, spend, and save without the misery of getting screwed six ways from Sunday in all aspects of one's financial matters.

OK, who's doing the screwing? Yeah, the big bankers have been around for centuries, and all over - I've just been concentrating on America, "cause we live here!" The kind of business that takes even a 1 %, but maybe often a 4-5% cut of EVERY SINGLE FINANCIAL TRANSACTION ON THE BOOKS is a BIG MONEY BUSINESS. That's big banking, taking those seemingly small cuts on a large economy. The people behind the big banks are extremely wealthy, powerful men, the kind with legends behind them - the Rothschilds, the House of Morgan, what have you. They have the power, via the money, to influence people in high levels of government to make sure they KEEP that money flowing in.

This brings up one last point I want to make. At this point in reading, a reader may well ask, "shouldn't you not be a libertarian then? Quit that silliness - we NEED Big Gov to rein in these banksters!". No, see, this gets into the chicken-or-the-egg question - who came first, the big banks or big gov? It's not exactly like the chicken/egg question though, as the answer is: The big banksters had, and could have again, NOTHING TO INFLUENCE, were the Federal government as small as the Founders envisioned, and as it went for ~ 150 years. If there is not much that government is involved in, especially financially, then what power do the banksters have? Once the government is let to get big, by an uncaring voting population, then the banksters have the power via Big Gov to make Big Gov bow to their wishes. "♪♫♬ Mister, we could use a man like Andrew Jackson again ... ♪♫♬

Oh, yeah, to finish the chicken-or-the-egg analogy, I think the voters are the chickens right now, and if they'd only wise up and listen to Peak Stupidity and Ron Paul, they could break a few bankster eggs ... you know... to make a free market omelet.

* This was done due to the wish of the French government to redeem dollars, as they recovered from their expensive foray into Vietnam, and America was in the middle of its one. We obviously didn't have the gold to back up the dollars.

Comments: